The 4% rule in retirement has been a widely accepted retirement standard for over 30 years.

Briefly, the rule states that you should draw 4% of your assets from your investments each year in retirement. This should, in theory, allow you to maintain a comfortable standard of living while continuing to let your investments appreciate in value.

However, it seems this longstanding rule could be poised to fall.

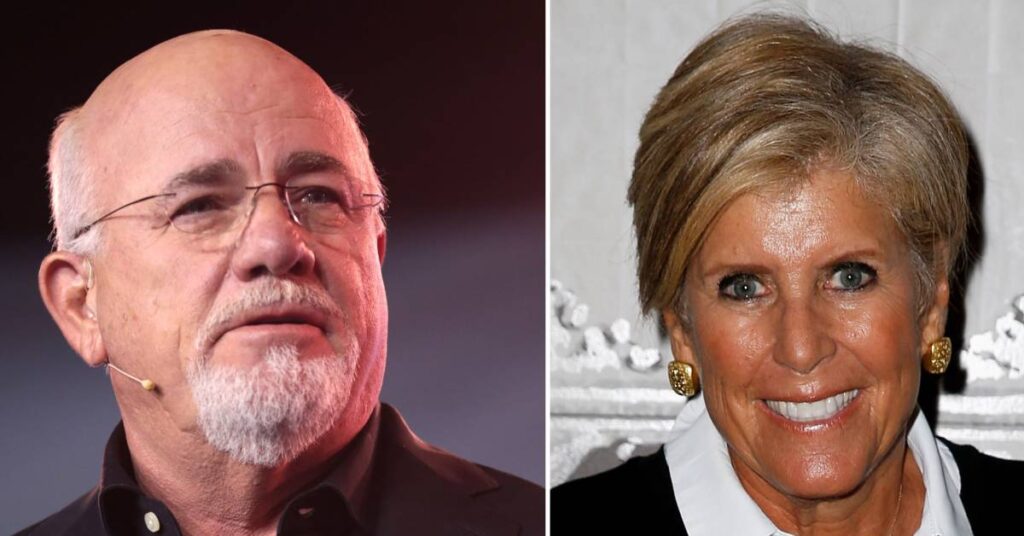

A recently retired caller to The Ramsey Show asked host and finance personality Dave Ramsey if it would be safe to go up to a 5% withdrawal rate in order to pay for trips he and his wife wanted to take in early retirement. The financial influencer counseled the caller to draw 5% or 6%, even adding, “If you want to draw out 10%, you’re not going to destroy the portfolio.”

Ramsey has said he believes that retirees can earn up to a 12% annual return from mutual funds, and will therefore be safe to withdraw more than the standard 4% per year without jeopardizing their nest egg. He calls the standard rule “absolutely wrong” and “ridiculous.”

But another finance celeb has a very different opinion.

Suze Orman, on the other hand, has called the classic 4% rule “very dangerous.”

Orman, a fellow best-selling author and expert, also called for a tweak to the 4% rule in an interview with Moneywise — saying that retirees should only withdraw a maximum of 3% yearly if they are retiring in their 60s.

Who’s right? Here’s what to consider.

Ramsey’s advice is based on a number of suppositions that may not reflect the real financial status of the average retiree.

Inflation will eat away at the value of your retirement savings, and it’s very possible that your retirement years could coincide with a period of higher inflation — like what the U.S. has seen in the last few years. With inflation like the eye-watering 8% we saw in 2022, an 8% withdrawal from your retirement account would not stretch as far as you anticipated.

That’s not to mention the stock market’s volatility. Many experts believe a consistent 12% return, like Ramsey has optimistically said mutual funds can deliver, may not be likely.

Moreover, his advice is best for those with large portfolios. Many Americans don’t have deep pockets, as according to Vanguard, the average retirement savings for those over 65 is just $232,710. Withdrawing at 8% could mean that retirees risk outliving their savings.

Suze Orman’s advice, on the other hand, is more conservative. She advises retirees to withdraw as little as possible from their savings, which is a safer (if not always practical) approach.

Either expert would argue that the best way to make your money last in retirement is to start saving as early and as aggressively as you can.

One of the best ways to save for retirement is with an IRA. But with the fluctuations of the market, you may be wondering if there are safer investment options available. Opening a gold IRA with help from American Hartford Gold combines the tax advantages of an IRA with the inflation-resistant properties of gold.

Gold has historically acted as a hedge against inflation, and many find it to be a more secure place to invest their retirement fund.

As one of the nation’s most reputable and trusted precious metal companies, American Hartford Gold is a source for IRAs and direct purchases of precious metals and coins that many retirees trust.

Before you begin investing however, you need a plan. And while Ramsey and Orman make good points on withdrawal strategy, you may need help that’s more tailored to your personal situation. If you’re unsure of how to navigate planning for retirement on your own, calling a professional give you some peace of mind.

Advisor.com can help you find the right financial professional for you. Their online platform connects you with vetted financial advisors, simplifying the process by having your start by answering a few quick questions about yourself and your money goals.

You can view the advisors’ profiles, read past client reviews, and schedule a free consultation with no obligation to hire.

Read more: Rich, young Americans are ditching the stormy stock market — here are the alternative assets they’re banking on instead

If you’re already in retirement, you may want to follow Ramsey’s advice on growing your existing savings with safe vehicles like mutual funds. However, many retirees have not considered the benefits of certificates of deposit, whose returns can now exceed 5%.

Between 2008 and 2022, when certificate of deposit rates were practically zero, and their appeal to investors about the same, they fell out of favour. But since the Fed has aggressively raised interest rates to combat inflation, CDs have become a hot topic once more.

Parking your savings in these short-term growth funds will allow you to plan year-to-year and continue to grow your savings when you’re on a fixed income.

With CD Valet – an online CD marketplace – users can shop and compare top certificate of deposit rates from various banks and credit unions nationwide.

Their extensive database shows the most competitive rates without bias, with daily rate updates and earnings calculators which give consumers an array of free tools to help them find the right CD to meet their retirement and savings goals.

You can also check out Moneywise’s Best High Yield Savings Accounts of 2024 to find some savvy savings options that earn you more than the national average of 0.4% APY.

Dave Ramsey is a huge advocate for finding new passive income streams to pay down debt and build savings. While much of his advice is focused on finding a lucrative side hustle, for those in their golden years, a more relaxed approach may be easier to incorporate.

One of the easiest ways to grow your savings and portfolio is through Acorns, an automated investing and saving platform that simplifies the process of setting aside extra funds.

When you spend on anything — groceries, gas, or bills — Acorns automatically rounds up the price to the nearest dollar and deposits the difference into a smart investment portfolio for you, allowing you to grow your wealth without even thinking about it.

Sign up now and for a limited time you’ll get a $20 bonus investment.

While many retirees are relying on their home sale or other real estate investments to fund their retirement, Suze Orman cautions that it may not be the right choice for some investors as owning a rental property isn’t quite the passive income source some may think it is.

“I would be careful with considering real estate to be a passive investment,” she said. “If you look at what’s happening to home insurance and the premiums, it’s [no longer a matter of] can you just afford to buy a home. Now it’s [about] can you afford to buy it, and keep it. There are many people who are able to afford a home, but can’t afford to keep the home, because their home insurance premiums went from $2,000 a year to $10,000 a year.”

When you consider escalating costs for materials and services for repairs, coupled with increasing rates of natural disasters, buying homes to rent or for investment may not be a realistic part of your retirement plan. However, you can still reap the benefits of the hot real estate market, thanks to platforms like Arrived.

Backed by world-class investors like Jezz Bezos, Arrived allows you to invest in shares of rental homes and vacation rentals without taking on the responsibilities of property management or home ownership.

Simply browse their curated selection of homes, each vetted for their appreciation and income potential. Once you find a property you like, you can choose the number of shares you want to buy and start investing in real estate with just $100, thereby skipping out on the risks Orman warns buyers about.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.