2023 State of Residential Construction Industry Report Highlights Better Builder Profit Margins, Jobs Delivered on Time & Higher Salaries Despite Supply Chain Delays, Extreme Weather, and Staff Shortages, Report Reveals Positive Outlook

Houston, Texas

|

March 28, 2023 06:00 AM Pacific Daylight Time

Houston, Texas

|

March 28, 2023 06:00 AM Pacific Daylight Time

The Association of Professional Builders (APB), a leading business coaching service for custom home builders, with members in the United States, Canada, Australia and New Zealand, today announced the findings from its annual State of Residential Construction Industry (SORCI) Report for 2023. The report, compiled annually, surveys 1,000 residential home builders operating in the United States, Canada, Australia, and New Zealand, and is commissioned to gather deeper insights into the residential construction industry and spot emerging trends to enable building company owners to benchmark their own businesses against industry standards. Participating sponsors for the 2023 report included Buildertrend, Builder Lead Converter, Buildxact, BuildTools, CBUSA, and Builder Nuggets Podcast.

Key findings for 2023 indicated:

Despite material delays and other supply chain shortages, extreme weather, and personnel shortages, 57.7% of jobs were delivered on time.

Average contract values increased from 2021, with a steep incline of contract values in excess of $1 million, showing building companies’ business growth.

Generating quality leads remains the top key challenge for builders; 40.4% of builders surveyed cited this as their number one sales issue.

The 2023 SORCI Report explored four key areas of insights for builders: finance, sales, marketing, and technology.

Builder finances

One of the most critical areas for builders’ financials is their understanding of cost escalation clauses as it relates to their own contracts. In Australia, 33% of builders declared their contracts incorporate special conditions to include cost escalation clauses. This number still lags behind New Zealand’s builders where 85.5% have protected themselves, the United States with 61.8% and Canada 44.1% covering themselves.

Financial understanding has not been at the level it needed to be for builders in previous years, however that is clearly starting to change. Even more encouraging is that 70.5% of builders showed they understand the difference between markup and margin. This statistic is further substantiated because the builders who claimed to know the difference were also tested.

Almost three quarters of builders (74.8%) also know their fixed expense ratio, which is calculated by dividing total expenses by revenue. Over half of the builders surveyed (57.3%) are producing monthly financial reports and 60% monitor the gross profit margin on every job on a monthly basis enabling them to have their finger on the pulse of every single job.

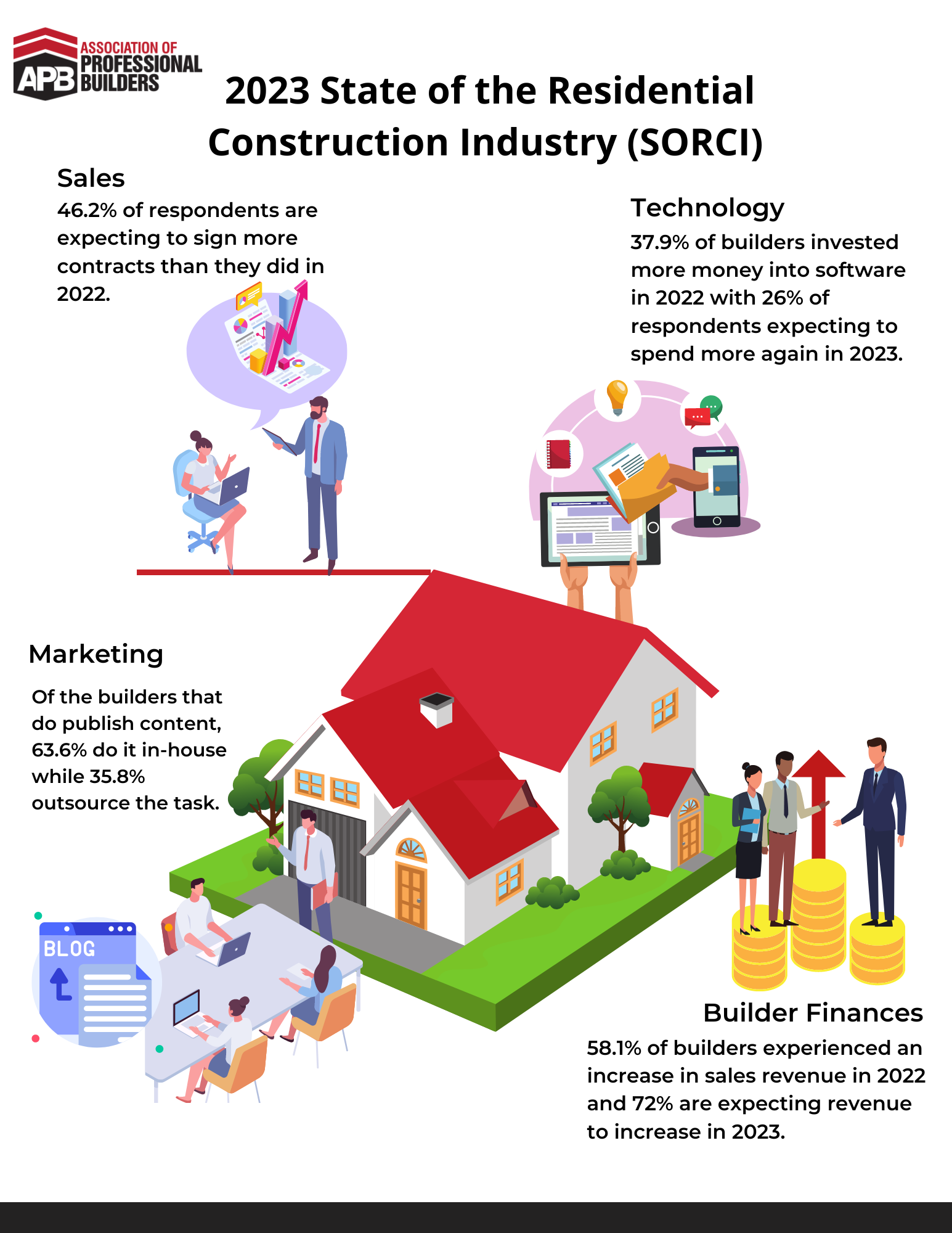

Additionally, 58.1% of builders experienced an increase in sales revenue in 2022 and 72% are expecting revenue to increase in 2023.

“It’s great to see builders’ revenues increase,” said Russ Stephens, Co-Founder, APB. “As builders become smarter about their finances, in particular in the areas of cost escalation clauses, the differences between markups and margins, and their fixed expense ratios, among other key financial scenarios, they will truly be able to continue to improve their bottom lines and thrive, no matter the market conditions.”

Sales

While builders’ contract values increased, the area of sales continues to be one of the more challenging areas for builders according to the report. 40.4% of builders cited their number one sales challenge is generating quality leads. Additionally, only 50.3% of building companies reported that they have a documented sales process. The positive takeaway from this is, however, that companies that have a documented sales process in place are approximately four times more likely to achieve industry standard gross margins of 25% and above.

The outlook from builders for the year remains quite similar to 2022, with 46.2% of respondents expecting to sign more contracts than they did in 2022.

Marketing

One of the key marketing tools cited by builders across all geographies surveyed is YouTube as a key platform. Builders in Canada showed they are leading the way on this channel with 20.5% of building companies uploading at least one video per month.

Publishing content on a blog remained similar to 2021 data with 64.1% of building companies not creating any content over the past 12 months. Of the builders that do publish content, 63.6% do it in-house while 35.8% outsource the task.

Marketing represents a huge growth opportunity for builders and is more than likely the reason why the few builders that are marketing correctly are finding it so easy to sign so many contracts at higher margins as there is little competition for those more marketing-savvy building companies.

Technology

Builders stand to gain efficiencies in utilizing technology and software. During 2022, 91.3% of builders handled their estimates in-house, however in terms of outsourcing, it was New Zealand's builders that lead the way with 22.6% of builders trusting a third party with this time-consuming task.

A baffling trend emerged in terms of the number of builders now using spreadsheets to compile their estimates which actually rose from 31.1% in 2021 to 36.4% in 2022. Considering it has been well documented that 88% of spreadsheets contain errors, it's surprising that more builders have turned to spreadsheets as a solution. The exception to this trend was in Canada where only 24.2% of builders now use spreadsheets for their estimating compared to 52% in 2021.

Overall, 37.9% of builders invested more money into software in 2022 with 26% of respondents expecting to spend more again in 2023.

The full version of the 2023 SORCI Report can be downloaded complimentary at https://go.associationofprofessionalbuilders.com/sorci-download.

# # #

ABOUT ASSOCIATION OF PROFESSIONAL BUILDERS

The Association of Professional Builders is a leading business coaching service for custom home builders in the United States of America, Australia, New Zealand, and Canada. It provides tested and proven systems for builders to scale and succeed, based on data, experience, and results.

Contact Details

The Hoyt Organization

Alyson Campbell

+1 310-373-0103

The Hoyt Organization

Alana Van Slovis

+1 310-373-0103

Company Website