Digital Asset Direct

Digital Asset DirectTech the Halls

News Media Group, Inc.

Contact Details News Media Group, Inc. Karl Wayne +1 334-440-6397 karl@newsmg.com Company Website https://newsmg.com/

December 02, 2022 10:55 AM Eastern Standard Time

Video Digital Asset Direct

Digital Asset DirectNews Media Group, Inc.

Contact Details News Media Group, Inc. Karl Wayne +1 334-440-6397 karl@newsmg.com Company Website https://newsmg.com/

December 02, 2022 10:55 AM Eastern Standard Time

Video News Release

News ReleaseAccel India

With a large addressable market, growing online shopper base, and increasingly digitised MSMEs, online marketplaces in India contribute more than $100 billion in gross merchandise value (GMV), with B2C e-commerce marketplaces being the single largest segment, contributing $50 billion. Over the next five years, the marketplaces sector is expected to more than triple, to reach $350 billion in GMV. These marketplaces will be creating $400–$500 billion in enterprise value, contributing more than 5% to India’s GDP, enabling more than 15 million micro, small, and medium enterprises (MSMEs) to grow their businesses online, and creating 7 million jobs by 2027. These are among the findings of a new report “ The Rise of Digital Bazaars in India ”, released by Bain & Company and Accel today. Marketplaces have created tremendous value for individual buyers, for businesses, and for the economy alike. Arpan Sheth, Partner at Bain & Company and co-author of the report said “ Marketplaces have contributed to India’s growth story by offering greater access to capital and innovative financing solutions for traditionally underserved segments; enabled MSMEs to transact online, with an increased pan-India reach; and have provided employment opportunities to more than 3 million gig workers in India. India has cultivated a vibrant and successful marketplace landscape, demonstrated by the sheer breadth of more than 300 funded marketplaces across multiple categories like retail, education, healthcare, travel, financial services, etc. Almost 20 marketplaces reached more than $1 billion in GMV and many players are turning profitable. While online marketplaces will continue to be dominated by B2C e-commerce with 40% of the total GMV in 2027, the B2B e-commerce marketplaces GMV is slated to grow by five times its current size to reach $55 billion, followed closely by online food delivery which will almost triple in size to reach nearly $22 billion. Not just for buyers and sellers, marketplaces have also seen significant traction with investors in recent years, having received cumulative funding of $30 billion between 2018 and October 2022. B2C e-commerce, B2B e-commerce, and online food delivery were among the highest- funded marketplaces sectors, together accounting for close to 60% of total funding received in the last 5 years. From B2C e-commerce marketplaces leading the share of deal volumes in 2018, B2B e-commerce marketplaces emerged as the frontrunner in 2022, with deal volumes growing to 31% of the total deals in the year so far. 2021 was a landmark year, which saw funding in marketplaces reaching $16 billion, growing four times compared to 2018 and deal volumes doubling in the same period. However, in 2022 year-to-date (YTD) marketplace funding activity has been moderate at $4.5 billion, given the tempering of 2021 highs, valuation corrections, and muted sentiments in global public markets. Prabhav Kashyap, Partner at Bain and Company and co-author of the report said, “ Dealmaking in the short to medium term is likely to be more measured and valuation multiples will see some degree of rationalisation. The future of marketplaces, on the other hand, is robust and with strong growth in their GMV and continued interest from investors, we expect the segment to see ample opportunities and a strong pick up. While the marketplace model is popular across multiple categories, upstream business-to-business (B2B), fintech, and shipping and logistics are some of the most exciting areas. These sectors show evidence of successful marketplaces as well as significant headroom for growth of new or emerging players.” Upstream B2B presents as a $1 trillion+ opportunity and a high margin potential; with fragmented supply, need for disintermediation, and government initiatives being key growth drivers. Fintech marketplaces have also grown owing to the low penetration of financial/insurance products, digitisation of user base, and availability of easy-to-use digital platforms. An approximately $200 billion addressable market and supply chain inefficiencies have resulted in a surge of tech-based shipping and logistics marketplaces. Anand Daniel, Partner at Accel and co-author of the report said, “India is one of the world’s fastest growing and most dynamic emerging markets. Our report on the country’s digital bazaars reveals the extent to which marketplaces have grown in this market across both business-to-consumer and business-to-business segments. More than 1/3rd of large outcomes in our start-up ecosystem have been marketplaces and contribute to more than $100 billion in GMV. Accel India is fortunate to have partnered with many of these marketplaces from seed to scale. We have invested more than $700 million in these companies, and continue to look for more such opportunities.” The report highlights that the next wave of scale marketplaces has the potential to emerge in two additional major categories— (1)‘Bharat-first’ models driven by participation from tier- 3+ cities, and (2) global cross-border models addressing the export potential India has. Gaming, caregiver services, creative content, Web 3.0, have large-scale marketplaces in mature markets, but are currently nascent in India. They represent future trends in the Indian marketplace landscape, and are a precursor for these segments to grow large in India given proof of scale in US and China, where multiple unicorns are present in these areas. About Bain & Company Bain & Company is a global consultancy that helps the world’s most ambitious change makers define the future. Across 64 cities in 39 countries, we work alongside our clients as one team with a shared ambition to achieve extraordinary results, outperform the competition, and redefine industries. We complement our tailored, integrated expertise with a vibrant ecosystem of digital innovators to deliver better, faster, and more enduring outcomes. Our 10- year commitment to invest more than $1 billion in pro bono services brings our talent, expertise, and insight to organizations tackling today’s urgent challenges in education, racial equity, social justice, economic development, and the environment. Since our founding in 1973, we have measured our success by the success of our clients, and we proudly maintain the highest level of client advocacy in the industry. For more, visit www.bain.com/india or https://twitter.com/BainIndia About Accel Accel is a global venture capital firm that aims to be the first partner to exceptional teams everywhere, from inception through all phases of private company growth. Accel has been operating in India since 2008, and its investments include companies like BookMyShow, BrowserStack, Flipkart, Freshworks, FalconX, Infra.Market, Chargebee, Clevertap, Cure Fit, Musigma, Moneyview, Mensa Brands, Myntra, Moglix, Ninjacart, Swiggy, Stanza Living, Urban Company, Zetwerk, and Zenoti, among many others. We help ambitious entrepreneurs build iconic global businesses. For more, visit www.accel.com or https://twitter.com/Accel_India Contact Details Bilal Mahmood +44 7714 007257 b.mahmood@stockwoodstrategy.com Company Website https://www.seedtoscale.com/marketplaces/digital-marketplaces-in-india

December 01, 2022 08:00 AM Eastern Standard Time

Image Digital Asset Direct

Digital Asset DirectNews Media Group, Inc.

Contact Details News Media Group Karl Wayne +1 334-440-6397 karl@newsmg.com Company Website https://newsmg.com/

December 01, 2022 06:00 AM Eastern Standard Time

Video News Release

News ReleaseAssembly

Global omnichannel media agency Assembly has elevated Jon Harper to a new role as Chief Client Officer for its European business. The role is the first of its kind for Assembly in the region, signaling the increasing importance of Client Experience & Leadership within the agency. Over the course of Jon’s 6-year tenure with Assembly, he has worked with clients including Lenovo, Ralph Lauren, Tommy Hilfiger, Calvin Klein, and Converse with great success, building strong relationships across the board. With his new appointment, Harper will be leading every step of the client relationship journey in the business for Europe. “Assembly has grown and evolved to become a true global force beyond digital media, leading the agency to win large omnichannel deals and expanding existing client relationships. Through this, we have identified the need to go further to support clients with a broader set of solutions at a high service level in order to promote growth in a constantly evolving media landscape. Our aim is to ensure clients have the best data, tech, and talent in the industry,” said Jon Harper, Chief Client Officer, Assembly Europe. Part of achieving this has been the creation of the Client Experience and Leadership pillar (CEL), led by Harper in Europe and other leaders across Assembly’s business. This ongoing investment focuses on driving new standards of creativity and improving the agency’s viewpoint on clients’ needs. This has included “brand immersion days” and stepping outside of standard client-agency interactions through hosting Q&A sessions all the way through to getting back to the basics by visiting brand stores and speaking to front-of-house staff to truly know the heart of each brand the agency works with. Jon added, “We firmly believe that everyone is a part of client services within the agency. That’s why we’re training everyone to be immersed in our clients’ brands – my goal is for all of our teams to have more dedicated client service time and to roll out our new global CEL toolkit to assist with this.” Assembly Europe’s Managing Director, Kate O’Mahony commented, “We are delighted about Jon’s elevation to Chief Client Officer. His rich experience and willingness to go above and beyond when it comes to getting to know our clients has proven fruitful. With Jon leading this division, we will continue to drive proactive relationships and deliver higher levels of innovation in connecting Assembly with our existing and future clients.” ABOUT ASSEMBLY: Assembly is the modern global omnichannel media agency, bringing data, talent, and technology together to find the change that fuels growth for the best brands on the planet. Our approach connects big, bold brand stories with integrated, global media capabilities that deliver performance and drive large-scale business growth. Our work is powered by our proprietary, in-house technology solution, STAGE, and led by our global talent base of over 1,600 people around the world. We’re purpose-driven at our core and pioneers in social and environmental impact in the agency world. Assembly is a proud member of Stagwell, the challenger network built to transform marketing. Contact Details Assembly Gunilla Huddleston, VP of Marketing, Europe gunilla.huddleston@assemblyglobal.com Company Website https://www.assemblyglobal.com/

November 29, 2022 01:00 PM Eastern Standard Time

Image News Release

News ReleaseYourUpdateTV

According to the Consumer Technology Association, more than 60% of Americans – about 191 million people – plan to give someone a tech-present this year. But finding the right tech gifts – and staying within your budget – can be a challenge. Recently, Tech and Lifestyle Expert Stephanie Humphrey participated in a nationwide satellite media tour to discuss the hottest tech gifts this holiday season. A video accompanying this announcement is available at: https://youtu.be/XW8HKAWu0Wk Home Office Must-Haves With more Americans working from home than ever before, there has been increased demand for productivity tools and technologies that can help make us more efficient. So, whether you’re shopping for someone working remotely full-time, or someone on a hybrid schedule, it’s important to look for devices and gadgets that can help them stay organized. Stephanie really likes the smart and ultra-compact ScanSnap iX1300 Scanner, which helps users digitize, organize and share documents with the press of a button. With its compact size, the scanner fits on any size desk or remote office space and it’s WiFi enabled to help you stay organized wherever you need it. It’s a great resource for managing work or tax documents, and also comes in handy as way to digitize kids’ artwork when they bring their latest masterpieces home from school. Managing Your Holiday Budget Budgeting and finding the best tech gifts for your friends and family can be challenging – but by planning ahead and knowing what payment options are available to you, you can avoid the unnecessary stress of holiday shopping. To help give yourself more flexibility, turn to PayPal Pay Later, which lets you spread out payments over time to better suit your budget. PayPal Pay Later provides options to break purchases into four payments every two weeks or monthly payments for larger purchases, so you can select the option that works best for your budget and enjoy the holiday season. Experience Over Things Over the last few years, it seems more and more people are leaning toward gifts that provide a meaningful and memorable experience. Whether you’re are buying tickets to a show, booking a vacation, or picking up a gift card to someone’s favorite restaurant, these types of gifts truly keep on giving. And here’s one you probably didn’t think of – Rosetta Stone. Rosetta Stone is a unique and meaningful gift for anyone who wants to learn a language, connect with loved ones on a deeper level, or learn some helpful phrases before their next international trip. Rosetta Stone teaches you through bite-sized lessons that feature interactive activities and real-life scenarios to get you ready for conversation with real people. It’s available on Apple and Android devices, so you can learn anytime, anywhere. Gadgets for Kids When it comes to gadgets for kids, it’s a good idea to always looking for something that will stimulate brains and develop healthy habits. Kindle Paperwhite Kids is the perfect option for kids and is purpose-built for reading, which means there are no distractions from other apps, games, or videos. When a child sits down with their Kindle, they read on average more than an hour a day and with a 1-year subscription to Amazon Kids+, kids can gain access to thousands of books at their fingertips, from timeless classics to the most recent popular titles. Give the gift of reading and help establish healthy reading habits no matter where you are this holiday season. For more information, follow Stephanie on Instagram or Twitter at @techlifesteph About Stephanie Humphrey Technology and Lifestyle Expert Stephanie Humphrey is a former engineer who merges her passion for lifestyle media with in-depth tech expertise to show everyday people how empowering, enriching and fun technology can be. Stephanie is currently a technology contributor for ABC News where she works as part of the nationally-syndicated Strahan Sara & Keke team.Her expertise is built upon more than a decade as a Senior Systems Engineer at Lockheed Martin. Contact Details YourUpdateTV +1 212-736-2727 yourupdatetv@gmail.com

November 28, 2022 12:54 PM Eastern Standard Time

Video Digital Asset Direct

Digital Asset DirectNews Media Group, Inc.

Contact Details News Media Group Karl Wayne +1 334-440-6397 karl@newsmg.com Company Website https://newsmg.com/

November 25, 2022 02:00 PM Eastern Standard Time

Video News Release

News ReleaseCleverTap

CleverTap, the modern, integrated retention cloud today announced the launch of CleverTap for Startups (C4S). Through this initiative, CleverTap will offer a full stack retention platform to all budding digital-native brands, in order to help them personalize and optimize all customer touchpoints, improving user engagement and conversion. Till date, thousands of large digital-native brands have benefited from CleverTap’s platform which has solved their needs at scale, speed, and security. The aim now is to make solutions even more affordable for pre-launch, early-stage startups, or companies with limited monthly active users. New and early-stage businesses have very different needs from larger, well-established brands. They require more flexibility, affordability, and a partner that provides seamless support fuelling their growth plans. CleverTap has currently partnered with more than 50 venture capital firms, incubators, and business accelerators including Sequoia Surge, Techstars, Y-combinator, AWS Activate, Accel and others to provide exclusive discounts and resources to early-stage startups through this initiative. The C4S initiative was undertaken a year back and the offerings have now been fine tuned following feedback from 1000+ startups and is now ready to launch. Through this initiative, CleverTap aspires to be a growth partner for more than 100,000 new businesses by the end of 2025. Through this initiative, early stage startups can opt for a flexible plan with no minimum scale requirement, and can make use of the platform with as low as 5000 monthly active users. The platform is designed realizing the requirement of SMBs/startups. Additionally, customers will have the option to customize the platform with add-ons and will have the ability to only pay for the services they use. Speaking about the initiative Anand Jain, Co-Founder & Chief Product Officer, CleverTap said, “Every small business needs an ecosystem of stakeholders that are supportive and will help them get on their growth journeys. Be it small or big, startups can use all the help they can get. In our effort to bolster new businesses globally we are excited to launch CleverTap for Startups. Customer retention for consumer brands is one of the key components to building a successful business. By offering our solutions to startups at a lower cost with flexible options, we want to create an atmosphere where we can support new businesses from their 0 to 1 and then 1 to 100 journeys.” About CleverTap CleverTap is the World's #1 Retention Cloud that helps app-first brands personalize and optimize all consumer touch points to improve user engagement, retention, and lifetime value. It's the only solution built to address the needs of retention and growth teams, with audience analytics, deep-segmentation, multi-channel engagement, product recommendations, and automation in one unified product. The platform is powered by TesseractDB™ - the world’s first purpose-built database for customer engagement, offering both speed and economies of scale.CleverTap is trusted by 1500 customers, including Gojek, ShopX, Electronic Arts, TED, English Premier League, TD Bank, Carousell, AirAsia, Papa John’s, and Tesco. Backed by leading investors such as Sequoia India, Tiger Global, Accel, and CDPQ the company is headquartered in Mountain View, California, with presence in San Francisco, New York, São Paulo, Bogota, London, Amsterdam, Sofia, Dubai, Mumbai, Singapore, and Jakarta. For more information, visit clevertap.com or follow on LinkedIn and Twitter Forward-Looking Statements Some of the statements in this press release may represent CleverTap's belief in connection with future events and may be forward-looking statements, or statements of future expectations based on currently available information. CleverTap cautions that such statements are naturally subject to risks and uncertainties that could result in the actual outcome being absolutely different from the results anticipated by the statements mentioned in the press release. Factors such as the development of general economic conditions affecting our business, future market conditions, our ability to maintain cost advantages, uncertainty with respect to earnings, corporate actions, client concentration, reduced demand, liability or damages in our service contracts, unusual catastrophic loss events, war, political instability, changes in government policies or laws, legal restrictions impacting our business, impact of pandemic, epidemic, any natural calamity and other factors that are naturally beyond our control, changes in the capital markets and other circumstances may cause the actual events or results to be materially different, from those anticipated by such statements. CleverTap does not make any representation or warranty, express or implied, as to the accuracy, completeness or updated or revised status of such statements. Therefore, in no case whatsoever will CleverTap and its affiliate companies be liable to anyone for any decision made or action taken in conjunction. Contact Details CleverTap Sony Shetty sony@clevertap.com Company Website https://clevertap.com/

November 25, 2022 08:22 AM Eastern Standard Time

News Release

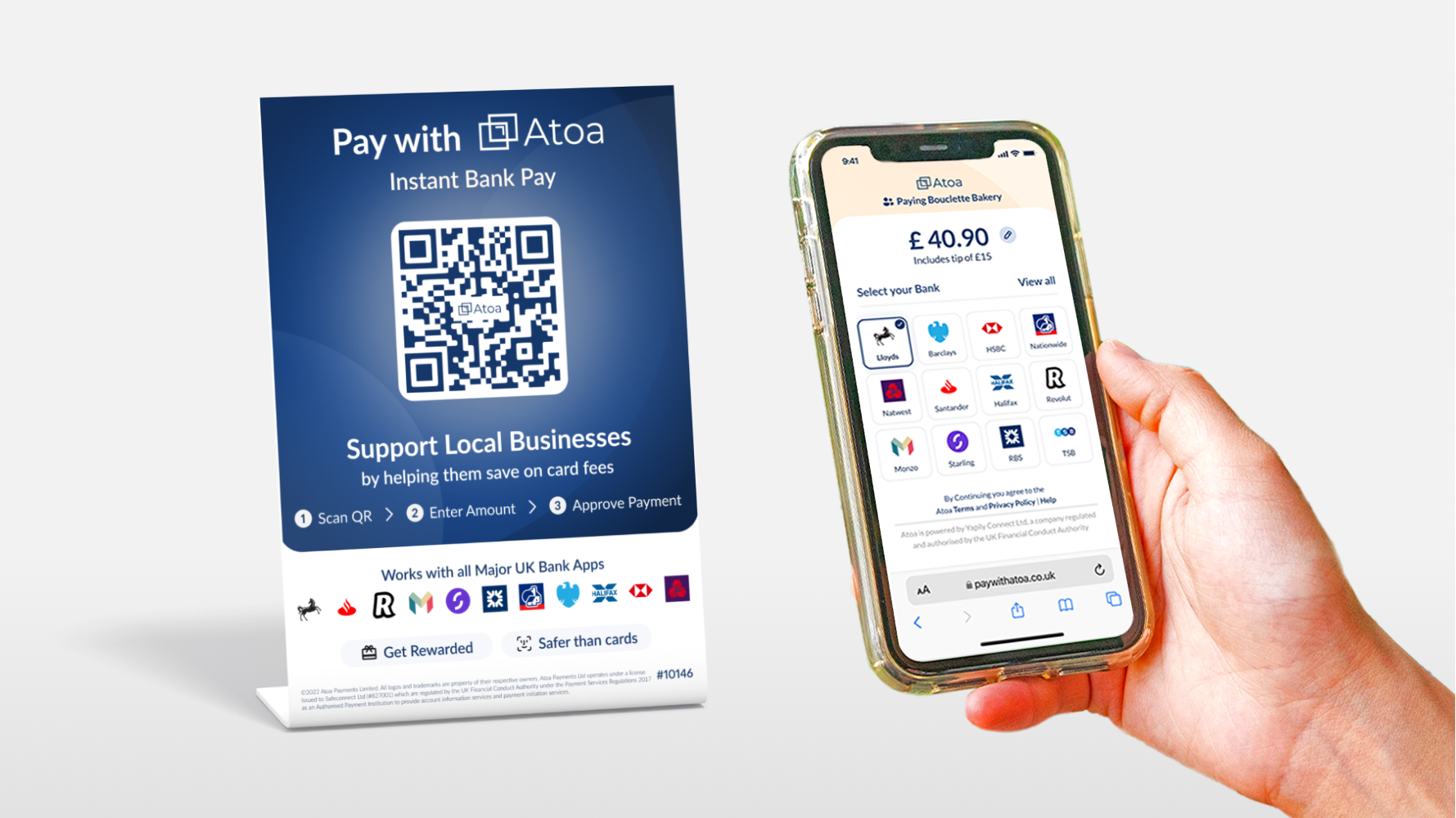

News ReleaseAtoa Payments

There are more than 4 million small businesses in the UK which have no viable alternative to debit card payments and are reliant on Mastercard or Visa payment rails. Challenging this status quo, UK fintech Atoa Payments is announcing a $2.2M pre-seed funding round to reduce by 70% the payment fees and offer a new approach to making payments. The funding round was led by Leo Capital and Passion Capital and also included well regarded angel investors such as Matt Robinson (co-founder of GoCardless and Nested) alongside Moon Capital Ventures. Anil Stocker, Co-Founder & CEO of MarketFinance also serves as a company advisor. Mastercard and Visa payment rails have an effective duopoly in the market which enables them to get away with net margins as high as 51% at the expense of small merchants and their customers. On top of this, card machine providers charge small businesses up to 1.75%. Atoa is building a truly viable alternative for small businesses to accept payments at a fraction of those costs and to improve their cash flow meaningfully at the same time. Using Atoa is seamless. Businesses simply download the Atoa app and securely connect their merchant bank account. Set up takes less than 5 minutes, after which the merchant can accept payments via SMS, Pay-by Link or by displaying a QR code on their Atoa App or physical QR stand next to their till. At the same time, their customers do not need to download a separate app to pay which removes a substantial point of friction inhibiting merchant options until now. Any customer with a UK mobile banking app on their phone can securely pay a merchant who is using Atoa. Without requiring a separate consumer app, the customer simply scans the merchant’s QR code or clicks on the link sent by the merchant, selects their bank and then is redirected to their existing mobile bank app to approve the payment, meaning that the merchant receives the funds instantly. Sid Narayanan, Co-Founder of Atoa Payments said, “We are grateful to have the support and partnership of such strong investors validating our plans to break the card payment duopoly in the UK and to improve cash flows and economics for the country’s small merchants. At a time of record inflation and in the midst of a cost-of-living crisis, the UK’s small and medium merchants are struggling to contain their costs, provide great service to the customers, and maintain profit margins. Atoa is here to empower merchants and to improve their cash flow and bottom line.” Atoa Instant Bank Pay allows small merchants to receive payments at a flat fee which is up to 70% cheaper than card machines provided by SumUp, Zettle or Square. The merchants then receive funds in their bank accounts instantly instead of having to wait 1-2 days as is the usual case with card machines and debit cards. Using Atoa involves no contracts (pay as you go), no hardware fees and no chargeback fraud risk (all payments are approved via bank app and have Strong Customer Authentication). By contrast, small retailers today are locked into contracts and typically have far from transparent fees to pay including authorisation fees, hardware fees, PCI compliance fees and more which all eat into their margins. Hardware fees can be as high as £29/month. Robert Dighero, Partner at Passion Capital, said “Atoa has come to the UK market at the right time to leverage open banking and bring to small and medium sized merchants a truly viable alternative to payment cards and card machines that can be deployed in-store within minutes. We’re delighted to work with the Atoa team after their first fintech success and look forward to partnering with them as they achieve even greater heights with Atoa. Shwetank Verma, Partner at Leo Capital, said “Leveling the playing field for independent, small and medium sized merchants is an obvious opportunity which benefits everyone, not least of which consumers. We have seen this business model succeed in India and SEA and we’re looking forward to working with the Atoa team to help them build another successful business in a massively growing market.” Since going live in June, the company has experienced more than 100% month on month growth in terms of both Total Payment Volume (TPV) and number of merchant customers. Over time, the founders’ ambitions are to become a mainstream small business friendly payment method replacing payment cards. About Atoa Payments Atoa was co-founded by Sid Narayanan, Cian O’Dowd and Arun Rajkumar, who all previously founded Singapore based fintech, KlearCard, which was acquired last year by Validus. Their first successful enterprise has motivated them to seek even greater heights and to have greater impact and to focus on one of the largest merchant retailer markets in the world, the UK. After securing their pre-seed funding round, the co-founders relocated to the UK and have achieved outstanding traction since summer 2022. About Passion Capital Passion Capital (passioncapital.com, @passioncapital) was established in 2011 to bring founder-friendly operationally-minded venture investing to the UK and Europe. Founded by former entrepreneurs instead of traditional asset fund managers, Passion was one of the first operator-led dedicated early-stage venture funds in Europe. Additionally, it was the first in the world to publish and use a plain English language term sheet and not to charge its portfolio companies any of its own legal or other fees, the first in Europe to publish fund infographics and to host joint office hours (for pitching sessions), and the first to manage a coworking office space. Over the last decade the team has invested in some of the strongest European founding teams including those from GoCardless, Monzo Bank, Lendable, Marshmallow, Tide Banking, Digital Shadows, Smarkets, Tray.io, urban, Spotahome, Butternut Box, Nested, PolyAI, Causal, Fertifa, Screenloop, Sequence, True Circle and many more. About Leo Capital Leo Capital is a Singapore based early stage venture fund, built by serial entrepreneurs with global experience. Leo Capital backs companies powering a software-enabled world and supports their founders on the journey from great founder to great CEO. We are excited about partnering with founders building the iconic companies of tomorrow. Please see http://www.leo.capital/ for more details. Contact Details Atoa Payments Bilal Mahmood +44 7714 007257 b.mahmood@stockwoodstrategy.com Company Website https://paywithatoa.co.uk/

November 24, 2022 06:00 AM Eastern Standard Time

Image Digital Asset Direct

Digital Asset DirectNews Media Group, Inc.

Contact Details News Media Group Karl Wayne +1 334-440-6397 karl@newsmg.com Company Website https://newsmg.com/

November 22, 2022 11:00 AM Eastern Standard Time

Video