UK SMEs forge ahead with cautious optimism as post-pandemic business confidence grows Half of SMEs are confident that customer demand, as well as turnover, will increase in 6 to 12 months, and the majority expect to grow over the next 3 years

London, UK

|

December 01, 2021 08:00 AM Eastern Standard Time

London, UK

|

December 01, 2021 08:00 AM Eastern Standard Time

Despite lingering anxieties about the pandemic and a variety of economic and commercial issues, the majority of SMEs believe it is now imperative to begin building back from the crisis. They are ready to step up their business investment, with ambitious plans for recruitment, renewal of equipment and machinery, and both domestic and international expansion. Fintech business lender MarketFinance asked 2,000 SME owners across the UK about their outlook for 2022 and beyond, gauging their short and long-term plans for business investment and growth. MarketFinance has today released a comprehensive research report of its findings.

Confidence

Analysis of the survey results has shown that business confidence amongst SMEs is improving, with many firms now focused on recovery and growth. With pandemic disruptions now largely settled, half of SMEs (48%) expect their turnover to stabilise or to increase over the next 12 months. Similarly, 50% of SMEs expect demand for their products or services to stabilise or to increase over the next six months. MarketFinance’s research has found that the majority of SMEs (63%) expect their business to grow over the next three years

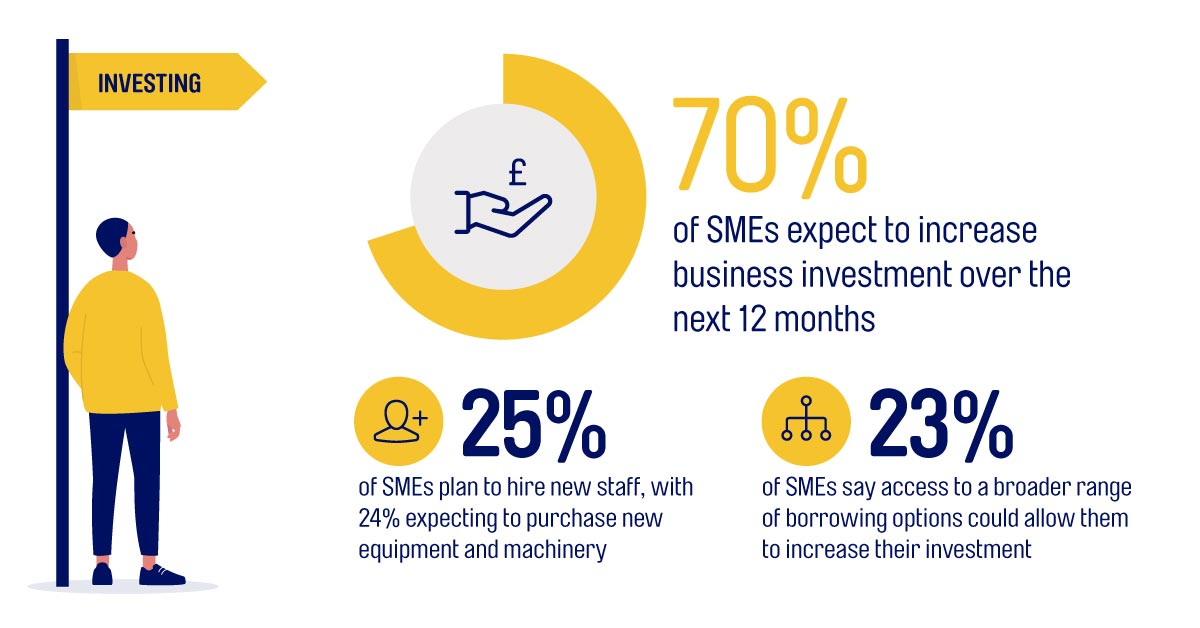

Investment

With survival mode no longer a necessity and cash flow pressures beginning to ease, the vast majority of SMEs (70%) now feel confident enough to increase business investment over the next 12 months. A quarter of SMEs plan to hire new staff, while 24% expect to purchase new equipment and machinery. When asked how they were factoring borrowing into their investment plans, 23% of SMEs said access to a broader range of borrowing options could enable them to increase investment even further.

Borrowing

The research findings demonstrate that borrowing will play a key role in recovery and growth with 62% of SMEs saying that prudent borrowing could help them fund growth. However, three quarters (71%) of SMEs do not believe traditional banking products are the most obvious and convenient way to borrow for investment. Despite this lack of alignment between current finance needs and the options available through traditional routes, more than a third of SMEs (37%) are looking to take on new borrowing facilities.

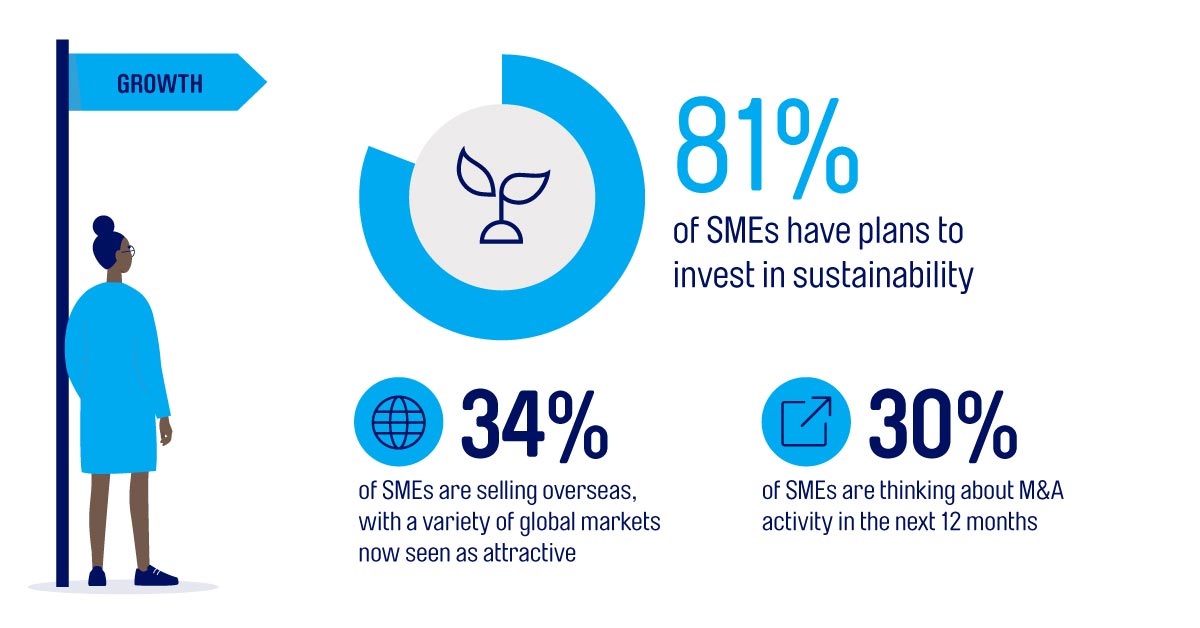

Growth

With confidence high and a sense of having moved beyond recovery and into a new stage of growth, many businesses are looking forward to seizing a host of opportunities in 2022. Almost all SMEs surveyed (81%) plan to invest in sustainability, while 30% say they are considering merger and acquisition (M&A) activity in the year ahead – more than twice as many as those primarily focusing on organic growth (14%). Over a third of businesses (34%) say they already sell overseas, or have plans to begin doing so. That figure is highest amongst the largest businesses surveyed (turnover between £5m and £6.5m) but even amongst smaller enterprises significant numbers are focused on export.

Anil Stocker, CEO at MarketFinance, commented: “It’s clear that the business environment has shifted and SMEs are looking ahead with a quietly confident and cautiously optimistic view. UK businesses intend to ramp up growth through domestic and international expansion, digital transformation and even M&A activity. But as they reset their post-pandemic goals for a post-pandemic, they’ll need to be confident of their funding base.

Given that so many SMEs are looking outside of traditional routes in their search for finance, we’re particularly proud to have been accredited by the British Business Bank as one of the few alternative providers under The Recovery Loan Scheme. Schemes like the RLS are a golden opportunity for SMEs looking to gear up for growth, providing easily accessible funding at a lower cost across a wide range of products. We expect to see a large number of SMEs taking advantage of the scheme over the next 6 months as their growth and expansion efforts gain momentum and they invest in ambitious plans for 2022 and beyond.”

About MarketFinance

MarketFinance is a fintech business lender which believes that SMEs are building the world. By making finance frictionless, they’re solving the cash flow issues getting in the way of progress. MarketFinance uses smart technology to deliver better access to faster, more affordable finance; with one-to-one help whenever businesses need it.

Since 2011, MarketFinance has advanced over £2.6 billion worth of invoices and loans, enabling thousands of UK businesses to bridge today’s funding gaps and fuel tomorrow’s big ambitions. MarketFinance is an accredited Recover Loan Scheme lender and has a wide-reaching network of strategic partners including Barclays Bank UK PLC, Tide, Equals Group and Ebury.

MarketFinance is backed by Barclays Bank UK PLC, Mouro Capital, Paul Forster (co-founder of Indeed.com) European venture capital fund Northzone (invested in Klarna, iZettle and Trustpilot), Viola Capital and private equity group MCI Capital (also invested in iZettle, Azimo and Gett). Further information visit: www.marketfinance.com

Contact Details

MarketFinance

Bilal Mahmood

+44 7714 007257

b.mahmood@stockwoodstrategy.com

Company Website