Richmond, VA

|

March 02, 2023 09:25 AM Eastern Standard Time

Richmond, VA

|

March 02, 2023 09:25 AM Eastern Standard Time

By David Butler

In the world of fashion, one bag reigns supreme and leaves celebrities and the ultra rich fighting amongst each other for positioning and the opportunity to own one. The bag is known simply as a “Birkin'', and since its inception in 1984 this bag has experienced a meteoric rise to its current place in the fashion world.

Originally sketched on a napkin during a flight from London to Paris, Jane Birkin probably never anticipated that her bags would one day start at prices of $10K USD, and be selling at auction for upwards of $380K. Accounting for inflation, one study that looked at the bags as an investment showed that they appreciated at a rate of 14.2% annually over a 35 year period, besting the S&P 500 which came in at 8.7%. These bags are so coveted, that they’ve become more than just fashion. They’ve become an investment.

The same can be said of Burgundy wines. Located in the Eastern part of France, Burgundies have long been known for their complexity, elegance, and depth of flavor. Now, they’re also known for their remarkable prices. The Burgundy 150 Index (used by the London International Vintners Exchange, or Liv-ex, as a way to track performance) has gained a remarkable 105.6% over the last five years (ended January 23rd) compared to 44.4% for the S&P 500 over the same time frame.

Like the Birkin is to fashion, the world of wine has a few producers that are so sought after that most of us will never get the chance to taste, let alone see a bottle. The pinnacle of Burgundy is largely considered DRC Romanée-Conti Grand Cru. A prime example of this blue-chip wine's dominance is the 2014 vintage. A single bottle can cost you more than $23,000, while the Liv-ex market value of a case has increased by nearly 63% over a five year period.

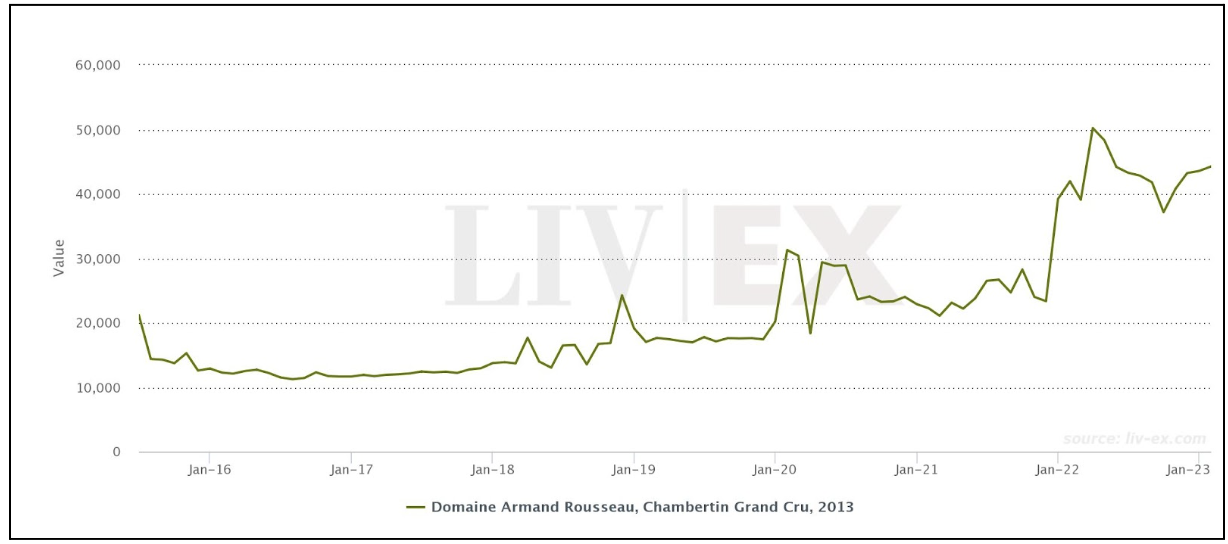

Other examples include Domaine Armand Rousseau Chambertin Grand Cru, which has gained 223.16% over a five year period, or the 2018 Batard-Montrachet Grand Cru which is up 26.2% over the last 12 months.

If a Birkin bag is the pinnacle of handbag investing, many of the top pinot noir from Burgundy are its counterpart. Despite the investment potential, fine wine is an asset class that can seem daunting to investors. Industry know-how is a big factor in making the right wine picks, maximizing gains, and realizing liquidity.

Whether it be Hermès bags, a piece of art or wine, investing in the asset class through a professional can be more conducive to long-term results, rather than simply storing a few wines in your basement. Companies like Vint offer a solution. Their platform allows investors to invest in shares of wine through securitized offerings, rather than having to go out and purchase an entire wine collection on your own. Their team researches the market, sources the wines, stores them safely, and finds buyers when the time comes. These are steps that can be very costly.

For those without industry experience, it can be difficult to understand the analysis and market dynamics that determine when to buy and sell. That’s why Vint’s in-house team of professionals use proprietary analysis and fundamental research to seek value and returns for their investors. Just don’t ask them about handbags.

This article originally appeared on Benzinga here.

Founded in 2019, Vint set out to financialize fine wine and spirits and create a new asset class. Vint received SEC qualification in 2021, thereby creating the first fully-transparent, efficient platform for wine, spirits, and futures collection investing. Vint offers expert-curated, thematic collections of fine wine & spirits to institutional, accredited, and non-accredited investors. Since launching, Vint has securitized and offered over $6M worth of assets. Through Q3 2022, Vint has generated returns of 28.3% for asset exits on a net annualized basis since inception. Vint is backed by leading investors Montage Ventures, MS&AD Ventures, Goat Rodeo Capital, Fintech Ventures & Slow Ventures. To learn more about Vint, visit Vint.co.

This content contains sponsored advertising content and is for informational purposes only and not intended to be investing advice. All investors should do their own research, due diligence, and make their own decisions when it comes to investing capital in markets. Please read Vint’s disclaimer.

Contact Details

Brady Weller

Company Website